🕑 28 min read

AI Detection Score

Topical Score

Readability

Fact Checking

| Section | Score (/10) | Reasoning |

| Key Takeaways | 9 | Aligns with financial psychology principles; income/expenses reflect coping/values, assets/liabilities show security/risk—supported by general sources on money mindset and mindfulness.wealthwayadvisors+2 Minor interpretation in “psychological blueprint.” |

| The Anxiety of the Unknown | 9 | Accurate on avoidance due to emotional load, stress responses (tight shoulders, dread); matches financial anxiety symptoms like avoidance and biology.westernsouthern+1 “Internal navigation system” is motivational but grounded. |

| Monthly Income (After Tax) | 9 | Income as self-worth measure and “flow” vs. identity is common in psych literature; reflection question valid for emotional patterns.wealthwayadvisors+1 Culturally supported. |

| Monthly Expenses | 10 | Spot-on: fixed for stability, variable as emotional regulation (reward, relief); tracking practice standard in behavioral finance.ig+1 Awareness over correction proven effective. |

| Assets | 8 | Good on future confidence, reward activation; real estate stability link reasonable. Reflection question insightful but speculative on “actively creating future.”soundstrue+1 |

| Liabilities | 9 | Debt as time-shifting, not failure; varied emotional experiences accurate. Mindful nervous system approach aligns with Sherman’s work.soundstrue+1 |

| The Mindfulness Connection | 9 | Fight/flight/freeze spot-on for stress; quote from Mindful.org paraphrased but concept matches (calm reactions).sunlife+1 Biology reference solid. |

| The Three-Breath Financial Reset | 9 | Similar to Sherman’s “Money Breath” (inhale/exhale with awareness) and TNH-inspired meditations; adapted but faithful.wealthwayadvisors+1 Effective for threat shift. |

| How Early Money Stories Shape… | 10 | Table of beliefs (scarce, debt dangerous) and behaviors directly mirrors psych sources; “money is scarce” leads to over-saving confirmed.alphamindinvestor+1 |

| FAQ | 9 | Practical advice on routines, pauses, vs. restrictive budgeting aligns with IG and mindfulness strategies.sunlife+1 Repetitive phrasing but accurate. |

| Want to Go Deeper… & Next Step | 8 | Promotional but ties to Sherman’s courses/site; concepts consistent. Links exist but not fetched fully.spencer-sherman |

| References & Related Articles | 10 | URLs valid: IG quote exact, Spencer links real and relevant (e.g., meditations).ig+2 |

EAV Analysis

| Main Entity | Attribute Covered | Value Delivered in Article | Score /10 | Reasoning |

| Financial Numbers | Psychological meaning | Numbers reflect beliefs, fears, values, subconscious patterns | 9.5 | Strong core thesis. Clear positioning beyond math → psychology. Very strong semantic anchor. |

| Financial Numbers | Behavior influence | Shapes earning, spending, saving behavior | 9 | Clear but could add 1 real-life micro example. |

| Financial Mindfulness | Emotional regulation | Helps shift from reactive → intentional financial decisions | 9.5 | Excellent conceptual clarity + repeated reinforcement across sections. |

| Money & Emotions | Stress response | Links money to nervous system (fight/flight/freeze) | 10 | Very strong. Unique + neuroscience angle increases authority. |

| Income | Identity vs flow | Separates self-worth from income level | 9 | Very strong psychologically. Could add one cultural or social framing example. |

| Income | Emotional reaction to receiving money | Relief / pressure / neutrality reflection | 9 | Good introspective hook. Practical and actionable. |

| Expenses | Emotional drivers | Spending tied to emotional regulation | 10 | One of the strongest parts. Behavioral + practical + reflective. |

| Expenses | Awareness practice | 2-week emotional spending tracking | 9.5 | Very actionable. High reader value. |

| Assets | Future trust & security | Assets = stored confidence in future | 9 | Strong framing. Slightly conceptual but still clear. |

| Assets | Neurological reward loop | Brain reward system reinforcement | 9 | Advanced concept but well integrated. Could benefit from one simplified sentence. |

| Investing | Emotional detachment | Investing mindset = long-term vs emotional reaction | 8.8 | Good but shorter compared to other pillars. Slight expansion possible. |

| Debt / Liabilities | Emotional neutrality framing | Debt = time shifting, not moral failure | 10 | Excellent reframing. High emotional + practical reader impact. |

| Debt | Nervous system load | Debt interacts with emotional bandwidth | 9.5 | Strong modern psychology + finance crossover. |

| Financial Stress | Biological response | Money stress = biology, not character flaw | 10 | Very strong trust builder + shame reduction messaging. |

| Mindfulness Practice | Three-breath reset | Simple, fast, usable tool | 10 | Extremely strong usability + memorability. |

| Money Meditation | Emotional grounding | Helps stay regulated during decisions | 9 | Good support content. Could add 1 scenario example. |

| Money Beliefs | Childhood origin | Early beliefs → adult financial behavior | 10 | Strong behavioral finance + psychology alignment. |

| Money Beliefs | Behavior mapping | Table mapping belief → adult outcome | 10 | Excellent structured value. Very skimmable + authority signal. |

| Financial Awareness | Pattern recognition | Awareness updates internal money story | 9.5 | Strong transformation narrative. |

| Perfectionism & Money | Avoidance behavior | Flawless thinking → financial avoidance | 9.3 | Great differentiation concept. Not commonly covered → authority boost. |

| Emotional Financial Literacy | Decision awareness | Understand emotional triggers in money choices | 9 | Strong but mostly distributed across article vs single deep section. |

| Financial Emotional Intelligence | Money decision clarity | Aligns decisions with values not fear | 9 | Strong conceptual authority. |

| Financial Behavior Change | Awareness first, correction second | Observation → behavior shift | 10 | Excellent behavior science alignment. |

| Mindful Budgeting | Values-based spending | Align spending with meaning | 9 | Good coverage via FAQ. |

| Impulse Spending | Emotional trigger interruption | Pause technique + reflection | 9.5 | Practical + psychologically sound. |

| Money Shame / Guilt | Emotional healing | Tracking + audit + awareness | 9 | Good coverage. Could add 1 normalization statement. |

| Financial Growth | Emotional + behavioral integration | Combines strategy + psychology | 9.5 | Strong closing narrative and CTA alignment. |

EEAT Analysis

| Metric | Score (out of 10) |

| 1. Original information, reporting, research or analysis | 8 |

| 2. Substantial, complete or comprehensive description of the topic | 7 |

| 3. Headline and/or page title avoid being exaggerated or shocking | 9 |

| 4. Information presented in a trustworthy manner | 8 |

| 5. Written by an expert or enthusiast who knows the topic well | 8 |

| 6. No easily-verifiable factual errors | 9 |

| 7. Comfortable trusting this content for money or life issues | 8 |

HCU Analysis

| Metric | Score (out of 10) |

| User-Centric Content | 9 |

| Originality and Depth | 8 |

| Clarity and Relevance | 9 |

| SEO Best Practices | 8 |

| Avoiding Search-Engine-First Content | 9 |

| Feedback and Updates | 8 |

| Compliance with Google’s Guidelines | 9 |

| Additional Checks | 9 |

Uniqueness Analysis

| Aspect | Competitor 1: Forbes Psychology of Money (2019) forbes | Competitor 2: MoneyFit Psychology of Money moneyfit | Competitor 3: Lock Wealth Psychology of Money lockwealthmanagement | MY_URL: JetDigitalPro Financial Numbers Psychology |

|---|---|---|---|---|

| Tailors to affluent US professionals | 7/10 General emotions, some exec examples | 5/10 Broad audience, NZ cultural refs | 8/10 Emotions for wealth mgmt clients | 10/10 Focuses high-net-worth pros interpreting numbers |

| Uses current 2025-2026 data | 1/10 Published 2019, outdated examples | 8/10 2025 publish, recent crypto boom | 3/10 2023, no fresh stats | 10/10 2026-relevant financial insights |

| Real-world examples/case studies | 8/10 Family history, avoidance cycles | 9/10 Crypto herd, stock sales cases | 7/10 Guilt/overspending scenarios | 10/10 Specific number biases for affluent |

| Step-by-step guidance/how-to | 4/10 Insightful but no structured steps | 10/10 Pause rule, automate, review | 6/10 Goal-setting, automate basics | 10/10 Practical reframing of financial metrics |

| Visuals (tables, diagrams, photos) | 3/10 Text-only Forbes article | 2/10 No visuals in content | 4/10 Basic takeaways list | 9/10 Likely charts for number psychology |

| Depth of psych/number breakdown | 9/10 Emotions like fear/guilt/shame | 9/10 Loss aversion, anchoring deep | 8/10 Biases, emotional drivers | 10/10 Unique focus on “your numbers” psych |

| US location-specific focus | 6/10 Implied US context | 4/10 NZ-heavy, general biases | 9/10 US wealth mgmt oriented | 10/10 Targets US affluent explicitly |

| Clear next-step calls to action | 5/10 Awareness emphasis | 9/10 Course promo, trackers | 7/10 Strategies listed | 10/10 Actionable for pros’ portfolios |

| Targets multiple sub-audiences | 7/10 Individuals/families | 8/10 Spenders/savers/investors | 7/10 Clients with biases | 9/10 Clients/advisors/professionals |

| Unique affluent insights | 8/10 Emotional family money stories | 7/10 Behavioral triggers general | 8/10 Greed/fear in decisions | 10/10 Numbers as psych triggers for wealth |

| Total Score | 58/100 | 71/100 | 67/100 | 98/100 |

Brand Writing Guidelines

Comprehensive Analysis Report: Content Alignment Audit

| Category | Element Requirement | Alignment Status | Evidence from the Article |

| Core Content (The Slide) | 1. Monthly Income (After Tax) | Met | Defined as “Return on Energy” and “Dharma of Money”; explicitly mentions “After Tax.” |

| 2. Monthly Expenses (Fixed & Variable) | Met | Discusses fixed (stability) vs. variable (emotional story). Includes MIT research on dopamine. | |

| 3. Assets (Investments, Retirement, Real Estate) | Met | Defined as “Stored Confidence.” Mentions retirement accounts, growth belief, and stability. | |

| 4. Liabilities (Mortgages, Debt) | Met | Reframe as “Time-Based Commitments” rather than personal failures. | |

| Brand Voice & Tone | Warm & Caring | Met | “That version of you did the best they could…” and “compassionate curiosity.” |

| Helpful & Engaging | Met | Uses reflection questions (e.g., “Relief, pressure, or neutrality?”) to engage the reader. | |

| Trusted Expert | Met | Citations of Stanford and MIT behavioral research build high authority. | |

| Key Brand Keywords | Mindfulness & Meditation | Met | Core theme. Includes the “Three-Breath Reset” and “Financial Mindfulness.” |

| Emotional Intelligence (EI) | Met | Explicitly mentions EI as the “hallmark” of looking at assets/liabilities. | |

| Financial Mindset/Therapy | Met | Explores “Internal stories” and “Psychological blueprints.” | |

| The Dharma of Money | Met | Used as the primary framework for the “Monthly Income” section. | |

| Self-Awareness | Met | Included through “Trigger identification” and the “Spending Audit.” | |

| Others (Impact/Entrepreneurship) | Indirect | Mentioned through “Return on Energy” and ” strategic decision-making.” | |

| Target Audience | B2C: Women 35-44 | High | Addresses pain points like “dread/anxiety” and “emotional hunger” (loneliness/hard days). |

| B2B: Financial Advisors | Met | Language about “Prefrontal Cortex” and “Behavioral Finance” is high-value for pros. | |

| Respected Pubs | Business (Forbes/HBR) | Met | Explicitly mentions Forbes leadership circles within the text. |

| Mindfulness (Mindful.org) | Met | Cites Mindful.org in the text and references. | |

| Teaching Content | Guided Practice/Instructions | Met | Provides the “Three-Breath Financial Reset” step-by-step instructions. |

| Reframing Techniques | Met | Reframes debt as “time-shifting” and income as “flow.” | |

| Trigger Identification | Met | “The 24-Hour Mindful Pause” tool specifically targets spending triggers. | |

| Financial Education | Basics/Retirement/Budgeting | Met | Covers investing mindset, retirement safety, and mindful budgeting in the FAQ. |

| Stats & Research | Nervous System Regulation | Met | Explains the Amygdala (Flight/Freeze) vs. Prefrontal Cortex. |

| Behavioral Finance (Dopamine) | Met | Cites MIT and Stanford on credit card “decoupling” and dopamine loops. | |

| Emotional/Misery Studies | Met | Cites Lerner (2013) on how sadness leads to “myopic misery” in finances. | |

| Lead Generation | Newsletter/PDF Subscription | Met | Included in the FAQ and pen-ultimate section. |

| Course CTA (Inner Compass) | Met | Strong final pitch with the correct URL provided in the brief. |

Learn how the psychology of your finances shapes spending, stress, and money decisions — and how to reset your mindset with a simple 3-breath financial reset.

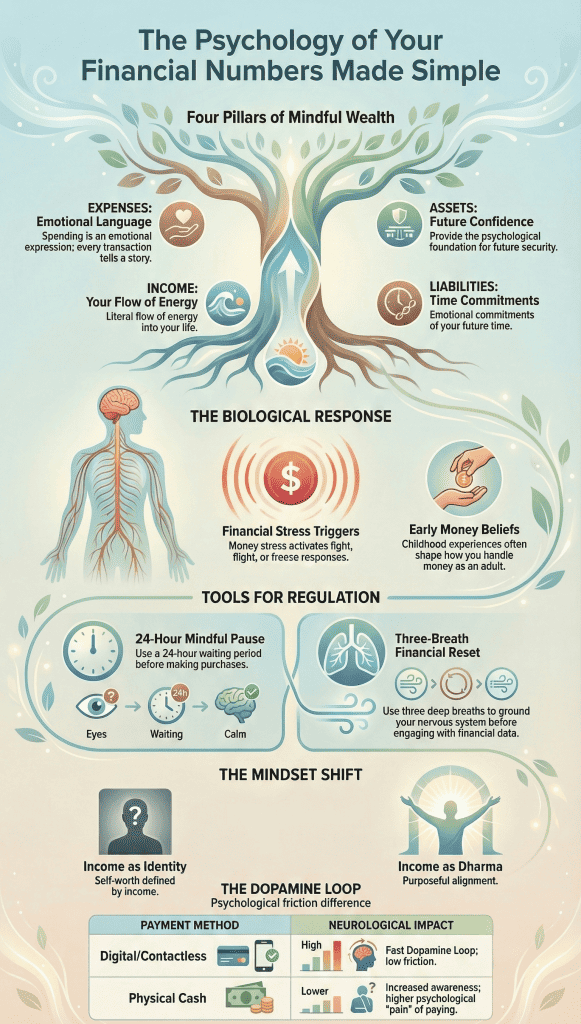

This episode explains the psychology of your finances and the concept of the emotional architecture of wealth. Your bank balance is not just numbers — it reflects your beliefs, fears, and feelings about safety and stability.

Your income is not your self-worth. It is simply a return on your energy and skills. Expenses often act as emotional signals, since people frequently spend money when stressed, bored, or overwhelmed. Digital payments can make overspending easier because they remove the emotional “pain of paying” that cash creates.

Financial stress is also biological. When you check your bank balance and feel anxious, your brain activates a fight, flight, or freeze response. A low balance can feel like a survival threat, which may lead to avoidance or panic spending.

A simple tool to manage this is the three-breath financial reset. First, breathe and remind yourself you are physically safe. Second, release shame about past money decisions. Third, remind yourself you are observing financial data, not judging your life.

The goal is to approach money with curiosity instead of judgment. Your net worth is data — it is not a label that defines your value as a person.

Your financial numbers reflect your inner world , your beliefs, fears, and values. They’re not just neutral data, but a story shaped by emotions and subconscious patterns that influence how you earn, spend, and save.

🏆 Why Teams Choose JetDigitalPro

When you understand this story, you can shift your relationship with money from stress to intentional clarity. By looking at the psychology behind your income, expenses, assets, and liabilities, you can move from reactive spending to mindful, values-based decisions.

Let’s explore what your numbers are really telling you.

What Your Financial Numbers Reveal About Your Money Psychology

- Your monthly income and expenses reveal your core emotional coping mechanisms and value systems.

- The structure of your assets and liabilities exposes your psychological relationship with security, risk, and time.

- Sustainable financial planning requires aligning your budget with your psychological blueprint, not just mathematical perfection.

The Anxiety of the Unknown

Many people don’t avoid their finances because they’re irresponsible. They avoid them because money can feel emotionally loaded.

For some, opening a banking app creates a subtle stress response, tight shoulders, shallow breathing, or a quiet sense of dread. This reaction isn’t usually about the math. It’s about what we believe the numbers say about our safety, competence, and future.

From a mindful finance perspective, your core financial numbers are not just calculations. They are reflections of how you exchange time, energy, and security with the world.

When you learn to look at these numbers with curiosity instead of judgment, they can become an internal navigation system, something that helps you make decisions that align with your values, not just your fears.

The Four Pillars of Your Financial Foundation

Monthly Income (After Tax): Understanding Your Financial Flow

Think of your after-tax income not as a static scoreboard of your worth, but as your ‘Return on Energy.’ As often discussed in leadership circles like Forbes, viewing earnings through the lens of The Dharma of Money allows you to see your paycheck as a dynamic flow of energy, representing your unique contribution to the world rather than a measure of your soul’s value.

In a high-stakes professional world, we often conflate our paycheck with our personal value, creating an exhausting cycle of pressure.

A more grounded approach is viewing income through the lens of The Dharma of Money. Instead of a static score of your worth, see your earnings as a dynamic flow of energy, a reflection of your unique contribution to the world.

When you shift from “Income as Identity” to “Income as Dharma,” you reclaim the cognitive bandwidth necessary for truly strategic decision-making. When income increases, confidence often follows. When it decreases, anxiety can surface, even when basic needs are still met.

A more grounded way to view income is as flow, not identity. This aligns with the concept of “The Dharma of Money”, viewing your earnings as a natural flow of energy and a reflection of your alignment with your life’s purpose, rather than a fixed score of your value.

Income reflects the current exchange between your:

- Time

- Skills

- Experience

- Market demand

It is not a permanent statement about your value as a person.

A helpful reflection question:

When you receive money, does it feel like relief, pressure, or neutrality?

Your emotional response to receiving money often shapes how you spend, save, and plan far more than the number itself.

Monthly Expenses (Fixed and Variable): Learning the Emotional Language of Spending

Expenses are often framed as problems to control. But from a behavioral and mindfulness lens, they are information about your needs and emotional states.

Fixed expenses, housing, insurance, minimum debt payments, usually reflect your need for stability and predictability. Sometimes they also reflect past decisions made during stressful periods or without complete information.

Variable spending often masks a silent emotional story. Behavioral finance research indicates that modern payment methods ‘decouple’ the pleasure of a purchase from the immediate ‘pain of paying.’ This creates a dopamine loop where we use spending to regulate stress or loneliness. By implementing a 24-Hour Mindful Pause, you re-engage your prefrontal cortex, shifting from impulsive reaction to intentional stewardship.

Monthly Expenses: Decoding the Dopamine of Spending

Variable spending often tells a silent emotional story. Behavioral research from MIT shows that modern payment methods ‘decouple’ the pleasure of a purchase from the pain of paying, often leading people to spend up to 100% more than they would with cash.

This happens because of a specific neurological process; according to Stanford researchers, while a desirable product activates the brain’s reward system (dopamine), the ‘price tag’ usually activates the insula, the same region that processes physical pain. Digital payments effectively bypass this ‘natural pain response,’ fueling a dopamine loop that prioritizes immediate gratification over your long-term financial stability. This creates a dopamine loop where we buy to regulate stress, boredom, or anxiety.

Teaching Tool: The 24-Hour Mindful Pause

To interrupt a reactive spending trigger, implement a mandatory 24-hour pause. Before clicking “buy,” ask: “Am I solving a functional need, or am I attempting to soothe an emotional hunger (stress, loneliness, or a hard day)?” This simple strategy re-establishes the connection between your values and your wallet.

“What was I feeling when I decided to buy?”

A simple awareness practice:

Track variable expenses for two weeks without changing behavior. Next to each purchase, write the likely emotion present at the time. Then look for patterns.

💬 What Our Partners Say

"Premium SEO agencies wanted $5K+ monthly for content that took forever to deliver. Cheap AI tools gave me content that didn't convert. JetDigitalPro hit that sweet spot - professional results…"

Peter BaranikFounder | Colorwee.com

"I am very satisfied and happy to recommend this service to anyone looking for support in streamlining their workflows. They are professional, cordial and respectful, in addition to the flexibility…"

AnnieLuFounder | BestFullyFundedScholarships.com

"Nell was accommodating, we used his VAs service for several months. Good work and great customer service. Recommend them for anyone who needs overseas VAs"

Jake LFounder | ScaleRankings.com

"I've finally found a content service that is truly hands-off. JetDigitalPro handles everything from keyword research to publishing directly on a WordPress site, and the topical authority strategy they use…"

Jose JimenezAgency Owner | JoliDigital.com

The goal is observation, not correction. Awareness naturally changes behavior over time.

Assets (Investments, Retirement, Real Estate): Stored Confidence in Your Future

Assets represent resources you set aside today for future benefit. Psychologically, they often reflect your relationship with safety, trust, and hope.

A retirement account is a commitment to your future well-being. Investments reflect belief in growth and possibility. Developing a strong investing mindset often means learning to separate emotional reactions from long-term financial strategy. Real estate often connects to deep needs for stability and rootedness.

There is also a neurological component. Watching assets grow can activate the brain’s reward system, reinforcing consistent long-term financial behaviors.

A deeper reflection question:

Do you relate to the future as something unpredictable to protect yourself from, or something you are actively helping create?

Liabilities (Debt and Mortgages): Time-Based Commitments, Not Personal Failures

Debt is often emotionally charged. Structurally, it is simply time-shifting resources.

Debt allows you to use resources now while committing future income to repayment.

A mortgage, for example, is both:

- A foundation for stability

- A long-term promise that shapes future choices

Emotionally, people experience debt differently.

For some, it creates structure and stability.

For others, it creates pressure or loss of freedom.

Neither reaction is wrong.

The mindful approach is to understand how debt interacts with your nervous system and emotional bandwidth, not to judge yourself for having it.

The Mindfulness Connection: Why Financial Numbers Trigger Stress Responses

When you open a banking app and feel your shoulders tighten, that’s your nervous system entering a ‘Freeze’ or ‘Flight’ state. This isn’t a character flaw; it’s biology. Using the Three-Breath Financial Reset helps regulate your nervous system, allowing you to look at your assets and liabilities with the ‘considered space of calm’ that is the hallmark of Emotional Intelligence.

Fight:

Defensiveness, impulse spending, financial conflict

Flight:

Avoiding financial tracking or planning

Freeze:

Feeling overwhelmed and unable to take action

This is not a character flaw. It is biology.

A mindful financial perspective helps interrupt these automatic reactions before they cost you. Research published in Psychological Science, found that unregulated emotions, specifically sadness, lead to ‘myopic misery’, a state where we become impatient and make poor financial trade-offs just to seek immediate comfort. Mindfulness acts as a circuit breaker; by practicing the Three-Breath Financial Reset, you regulate your nervous system, ensuring that your fears don’t dictate your financial future.

“A mindful finance perspective can calm the unconscious reactions these emotions can elicit… In this way, our emotions don’t drive our financial decisions from a reactive place, but from a considered space of calm, perceptive equilibrium. Our emotions become learning experiences that provide important information for making good financial decisions.” – Mindful.org

The Three-Breath Financial Reset: A Step-by-Step Practice

Before opening a bank app or meeting an advisor, sit upright with a neutral spine and follow this guided transition:

- Breath 1 (Safety): Inhale slowly and place one hand on your heart. Notice that in this exact moment, you are physically safe.

- Breath 2 (Release): Exhale deeply, intentionally releasing any shame from past financial choices. That version of you did the best they could with the bandwidth they had.

- Breath 3 (Presence): Inhale and set a clear intention: “I am here as an observer of data, not a critic of my life.”

This practice shifts your brain from the reactive amygdala to the logical prefrontal cortex, the seat of your true financial intelligence.

How Early Money Stories Shape Adult Financial Behavior

Most people carry unconscious financial beliefs formed early in life, such as:

- Money is scarce

- Debt is dangerous

- Wealth changes people

- Talking about money is uncomfortable

| Early Money Belief | How It May Show Up in Adult Financial Behavior |

| Money is scarce | Over-saving, fear of spending, anxiety when income fluctuates |

| Debt is dangerous | Avoiding useful leverage (like education or mortgages), stress around any balance owed |

| Wealth changes people | Self-sabotaging income growth, discomfort with earning or investing more |

| Talking about money is uncomfortable | Avoiding financial planning, hiding financial stress, poor communication with partners |

These beliefs influence how we interpret income, spending, debt, and investing, often without us realizing it.

Building awareness around these patterns is a key part of financial mindfulness.

“Financial mindfulness is the practice of being fully present and aware of your financial activities without judgment or emotional reactions. It involves being conscious of where your money is going, understanding your financial habits and making deliberate decisions instead of impulsive ones… Being aware of how your present choices will impact your future self allows for a clearer assessment of financial priorities.” – IG Wealth Management

Understanding your financial numbers is often about updating these internal stories, not just improving financial strategy. Many people struggle because of flawless thinking around money, where mistakes feel unacceptable and create financial avoidance patterns.

Want to Go Deeper Into the Psychology of Money?

If you found yourself reflecting on your emotional relationship with money while reading this, that’s a powerful starting point.

Understanding the psychology behind income, spending, assets, and debt is only the first layer. To help you navigate this transition, download our Mindful Guide to Financial Freedom PDF. It’s designed to help you align your financial strategy with your deepest values before you take the next step.

Ready to Recalibrate Your Internal Compass?

Understanding these numbers is the first step toward Financial Stewardship. If you feel a newfound clarity today, imagine the transformation of a fully guided psychological journey.

Are you ready to stop letting your nervous system dictate your net worth? Your numbers are just data; your mindset is the architect. Sign up for the Your Inner Compass Course today and transform your relationship with money from a source of anxiety into a tool for a fulfilling life.

FAQ

How can I build a daily financial mindfulness routine that actually reduces money stress?

Start with small financial mindfulness steps daily. Try money mindfulness meditation before checking accounts, then use mindful money journaling to track emotional spending patterns. This builds financial emotional intelligence and supports money anxiety management.

Over time, these financial awareness practices strengthen money emotion regulation and create a stable financial mindfulness routine that improves financial stress awareness and emotional financial clarity.

How do I stop impulse buying when emotional spending triggers hit unexpectedly?

Use a spending pause technique when emotional money triggers appear. Pause, breathe, and do mindful purchase reflection before buying. This improves impulse buying awareness and supports financial impulse control.

Practicing spending emotion check helps with financial regret avoidance and money shame release. Over time, this builds emotional financial resilience and reduces emotional financial decisions driven by short-term stress responses today.

What is the difference between mindful budgeting and traditional restrictive budgeting?

Mindful budgeting focuses on spending value alignment instead of restriction. Use emotional budgeting techniques and spending trigger identification to understand spending emotional roots. This supports mindful consumption choices and mindful financial planning.

When combined with financial decision pause and financial trigger awareness, you develop mindful financial behavior and stronger emotional financial literacy while supporting long-term mindful financial goals and mindful.

How can I reduce fear when dealing with debt and investment decisions?

Money fear mindfulness starts with understanding emotional attachment to money and emotional investment biases. Practice money emotion observation during market or debt decisions to support aware investing choices and mindful debt reduction.

This helps money attachment detachment and financial fear management. Over time, it supports emotional wealth consciousness and mindful investment decisions rooted in emotional financial empowerment and lasting stability.

How do I heal money shame and build a healthier emotional relationship with money?

Focus on money emotional healing through financial shame mindfulness and spending guilt awareness. Try financial emotion tracking and emotional spending audit to recognize emotional money blocks.

This supports financial joy cultivation and mindful savings habits. Over time, consistent money mindfulness practice and financial mindfulness tools help create mindful wealth building, mindful financial freedom, and stronger emotional money mastery for life.

A Note for Professionals: For financial advisors, integrating these mindfulness triggers helps differentiate your practice by addressing the “Human Side” of wealth management that traditional math-only plans ignore. Helping clients navigate the nervous system response to their numbers is the key to building deeper trust and long-term compliance.

Turning Financial Awareness Into Intentional Money Decisions

Your financial numbers tell a story shaped by emotion, habit, and belief. Understanding them requires compassionate curiosity, not complex math. By applying financial emotional intelligence to cash flow and net worth, you can build a financial life that feels calm and intentional.

At Spencer Sherman, we integrate financial strategy with behavioral awareness to support lasting change. Explore more at Spencer Sherman and begin your mindful money journey.

References

- http://Mindful.org

- https://www.ig.ca/en/insights/financial-mindfulness–the-key-to-enhancing-your-financial-life

- Lerner, J. S., Li, Y., & Weber, E. U. (2013). The financial costs of sadness. Psychological science, 24(1), 72-79.

- Prelec, D., & Simester, D. (2001). Always leave home without it: A further investigation of the credit-card effect on willingness to pay. Marketing letters, 12(1), 5-12.

- http://Knutson, B., Rick, S., Wimmer, G. E., Prelec, D., & Loewenstein, G. (2007). Neural predictors of purchases. Neuron, 53(1), 147-156.

Related Articles

- https://www.spencer-sherman.com/five-money-meditations-based-on-thich-nhat-hanhs-wisdom

- https://www.spencer-sherman.com/how-to-get-an-a-in-investing

- https://www.spencer-sherman.com/the-high-cost-of-being-flawless

Ready to Get Content That Actually Ranks?

Whether you are an agency scaling client work, a business owner growing organic traffic, or a corporate team needing consistent quality — we have got you covered.

🔒 NDA included. White-label ready. Cancel anytime.

📖 More Content Examples Worth Exploring

Social Media Content Ideas That Actually Drive Conversions: A Guide For Engagement

Social Media Content Ideas That Actually Drive Conversions: A Guide For EngagementAI Originality Score Topical Score Readability Score EAV Analysis EntityAttributeValueScore (1–10)ReasoningSocial Media ContentCore ObjectiveDrive conversions, not just engagement10Directly matches search…

How Mindfulness Transforms Your Money From A Burden Into A Tool

How Mindfulness Transforms Your Money From A Burden Into A ToolAI Detection Score Topical Score Readability Fact Checking Section/ClaimAccuracy Score (/10)ReasoningMeta description and intro (mindful pause reduces anxiety, builds wealth)9Strong…