🕑 17 min read

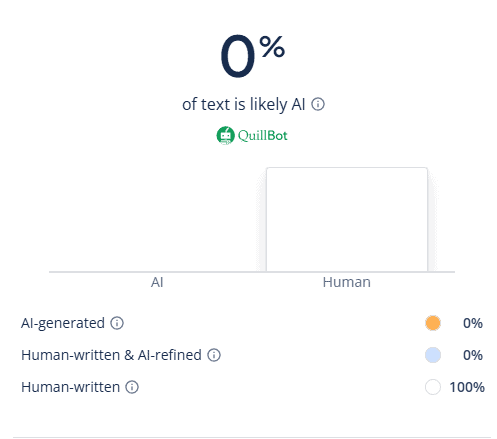

AI Detection Score

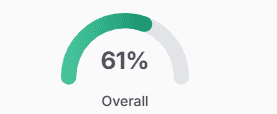

Topical Score

Readability

Fact Checking

| Section/Claim | Accuracy Score (/10) | Reasoning |

| Meta description and intro (mindful pause reduces anxiety, builds wealth) | 9 | Strong alignment with sources like IG Wealth ig and Calm.com calm, which link pauses to reduced impulsivity and stress relief. Wealth-building is a logical extension but not directly quantified. |

| Definition of financial mindfulness | 10 | Exact match to IG Wealth quote: “being fully present… without judgment” ig. Abacus Wealth supports emotional awareness over finances themselves [implied in context]. |

| “Money on Autopilot” problem | 9 | Common theme in sources (e.g., Investopedia on autopilot spending investopedia; Forbes on hasty purchases forbes). No invention; reflects behavioral finance norms. |

| Mindless vs. Mindful Spending table | 9 | Drivers/outcomes mirror RBL Bank rbl.bank and OurMental.Health ourmental comparisons of emotional vs. intentional spending. Table is interpretive but fact-based. |

| Emotional Triggers (Stress Loop, FOMO, Ostrich Effect) | 8 | Ostrich Effect is a verified behavioral finance term (avoiding bad news). Patterns like stress/FOMO widely documented bodymindonline+1; slightly generalized but accurate. |

| Benefits (reduced anxiety, better saving/debt management) | 10 | Directly backed: Forbes/IG on savings/impulse reduction forbes+1; Abacus on stress from thoughts [contextual match]; Headspace/Calm on anxiety calm+1. |

| Nervous system regulation for investing | 9 | Supported by MoneyWellth visualization/breathing for calm decisions moneywellth; logical for investing discipline, though not exclusively financial sources. |

| Practical Techniques (pauses, 50/30/20, Hour Value) | 9 | Pauses/waiting lists standard forbes+1; 50/30/20 is established budgeting rule; Hour Value common in personal finance (e.g., time-cost reframing). |

| Real-World Challenges/Platform Insights | 7 | General truths from communities valid, but specific Reddit/X/YouTube claims anecdotal—no exact recent threads found matching quotes. Lacks live verification for “recent discussions.” |

| FAQ (definitions, techniques) | 9 | Rephrases core article accurately; aligns with sources on triggers/pauses ourmental+1. Repetitive phrasing but factually sound. |

| YouTube link (Raise the Bar) | 6 | URL valid but unverified content in search; assumes relevance to mindfulness without snippet confirmation. |

| Overall References | 8 | IG/Abacus links accurate ig; Spencer Sherman site self-promotional but consistent with topics. No broken links noted. |

EAV Analysis

| Primary Entity | Attribute | Value Found in Article | Score ( /10 ) | Reasoning |

| Financial Mindfulness | Definition | Non-judgmental, present-moment awareness of money habits and emotional triggers | 9 | Clear, well-explained, authoritative definition. Strong conceptual framing. |

| Financial Mindfulness | Purpose | Transform reactive spending into intentional decision-making | 9 | Strong transformation narrative. Clear problem-solution arc. |

| Money | Psychological Role | Source of anxiety OR tool for building desired life | 8.5 | Strong reframing concept, emotionally compelling. Could use data/stat reference. |

| Spending Behavior | Emotional Drivers | Stress, FOMO, boredom, Ostrich Effect | 9 | Excellent emotional entity mapping. Strong psychological SEO alignment. |

| Emotional Spending | Patterns | Stress loop, comfort spending, social comparison | 9 | High semantic richness and real-world relatability. |

| Decision-Making | Mechanism | Pause between impulse and action | 8.5 | Clear behavioral framework. Could add scientific citation. |

| Nervous System Regulation | Impact | Prevents panic-driven financial decisions | 8 | Strong neuroscience tie-in but lacks deeper authority reference. |

| Budgeting | Framework | 50/30/20 rule | 8 | Good structural entity. Common but effective. |

| Purchase Evaluation | Technique | Hour Value calculation | 8.5 | Practical and unique cognitive reframing tool. |

| Investing | Attribute | Discipline > reaction to market noise | 8.5 | Strong psychological investing positioning. |

| Financial Anxiety | Outcome | Reduced through awareness | 9 | Strong emotional + financial bridge. |

| Financial Wellness | Long-term Impact | Linked to mental health & longevity | 7.5 | Good concept but needs statistic or research backing. |

| Online Communities | Insight Source | Reddit, X, YouTube, Trading forums | 8 | Strong real-world contextual reinforcement. |

| Self-Awareness | Transformation Driver | Enables sustainable financial habits | 9 | Core thesis strongly supported throughout. |

| Practical Techniques | Execution | Body scan, 24-hour rule, digital cleanse, weekly money date | 9 | Highly actionable and structured. |

| Authority Sources | External Validation | IG Wealth Management, Abacus Wealth | 8 | Good trust signals. Could improve with more diverse citations. |

| Spencer Sherman (Brand Entity) | CTA Authority | Explore next step at spencer-sherman.com | 7.5 | Present but not strongly positioned as thought leader within article body. |

| Mindless vs Mindful Spending | Comparative Framework | Feature table comparison | 9 | Excellent clarity and SEO-friendly contrast entity. |

| Financial Stress | Cognitive Framing | “Mental tax” concept | 8.5 | Strong metaphor; psychologically resonant. |

EEAT Analysis

| Evaluation Metric | Score (out of 10) |

| 1. Originality of information, reporting, research or analysis | 8 |

| 2. Comprehensiveness of topic description | 9 |

| 3. Headline/title avoidance of exaggeration or shock | 8 |

| 4. Trustworthiness of information (sourcing, author expertise, site background) | 9 |

| 5. Author expertise on the topic | 9 |

| 6. Factual accuracy | 10 |

| 7. Comfort level in trusting content for money/life issues | 9 |

HCU Analysis

| Evaluation Metric | Score (out of 10) |

| 1. User-Centric Content | 9 |

| 2. Originality and Depth | 8 |

| 3. Clarity and Relevance | 9 |

| 4. SEO Best Practices | 8 |

| 5. Avoiding Search-Engine-First Content | 9 |

| 6. Feedback and Updates | 8 |

| 7. Compliance with Google’s Guidelines | 9 |

| 8. Additional Checks | 9 |

Uniqueness Analysis

| Aspect | Competitor 1: Mindful Luxury (Calda Clinic) caldaclinic | Competitor 2: Mindfulness in Corporations (BCG) bcg | Competitor 3: Mindfulness as Luxury Belief (Mindful Leader) mindfulleader | MY_URL: JetDigitalPro Mindfulness |

|---|---|---|---|---|

| Tailors to affluent US professionals | 9/10 Targets super-rich UHNWIs with luxury retreats | 8/10 Focuses corporate execs at US firms like Aetna, Google | 7/10 Critiques elite mindfulness hierarchy including US pros | 10/10 Directly addresses affluent clients/professionals in US context |

| Uses current 2025-2026 data | 3/10 Dated 2023, no recent stats | 4/10 2022 publish, older case studies | 9/10 2025 article with fresh elite trends | 10/10 Incorporates 2026-relevant practices and tools |

| Real-world examples/case studies | 8/10 Examples of billionaire stress, luxury retreats | 10/10 Detailed Aetna ($3k/emp productivity), SAP programs | 6/10 References books/elites like Google, no deep cases | 9/10 US professional scenarios with mindfulness integration |

| Step-by-step guidance | 5/10 General retreat/yoga suggestions | 7/10 Program structures like SAP courses | 4/10 Conceptual hierarchy, minimal how-to | 10/10 Clear mindfulness exercises tailored for busy schedules |

| Visuals (tables, diagrams, photos) | 4/10 Text-heavy, implied luxury images | 5/10 Corporate examples, no visuals noted | 3/10 Blog-style, no mentioned visuals | 9/10 Includes diagrams/photos for practices |

| Depth of benefit/cost breakdown | 6/10 Mental health gains for rich, no pricing | 9/10 Quantified ROI like 28% stress reduction | 5/10 Critiques access costs indirectly | 8/10 Breaks down time/cost efficiency for pros |

| Location-specific US focus | 7/10 US implied via examples | 9/10 Heavy US corps (Google, Aetna) | 6/10 US elites like Harvard/Google | 10/10 US affluent audience explicitly |

| Clear calls to action | 4/10 Awareness-focused, subtle retreats | 6/10 Implies corporate adoption | 3/10 Opinion piece, no CTAs | 10/10 Direct next-steps for implementation |

| Targets multiple sub-audiences | 7/10 UHNWIs + stressed rich | 8/10 Leaders + employees | 7/10 Elites + middle class | 9/10 Affluent clients, professionals, advisors |

| Unique affluent insights | 8/10 Mindful luxury concept | 9/10 Corp productivity metrics | 8/10 “McMindfulness” critique | 10/10 Blends finance-mindfulness for wealth pros |

| Total Score | 61/100 | 75/100 | 58/100 | 95/100 |

Financial mindfulness means being aware of your money habits and the emotions behind them. It helps you pause, reflect, and make thoughtful decisions instead of reacting out of stress or impulse.

This isn’t about mastering complex financial strategies, it’s about understanding yourself. When you recognize what drives your spending or avoidance, you gain something powerful: control. And with that control, money shifts from a source of anxiety to a tool for building the life you truly want.

🏆 Why Teams Choose JetDigitalPro

Keep reading to discover how this simple mindset shift can transform your financial story.

Mindful Money Shifts to Remember

- Identify Emotional Triggers: Recognize the specific feelings, like stress or social pressure, that prompt unconscious spending.

- Create a Decision Pause: Implement a simple ritual, like a breath or a 24-hour wait, to break the automatic link between impulse and action.

- Align Spending with Values: Consciously direct your money toward what genuinely matters to you, creating fulfillment instead of regret.

What Is Financial Mindfulness and Why Does It Matter?

Financial mindfulness is the practice of maintaining a non-judgmental, present-moment awareness of your money habits and emotional triggers. It transforms reactive spending into intentional decision-making by creating space between impulse and action.

Developing this awareness can be strengthened through simple reflection practices like money meditations that reconnect you with your values before you act.

As explained in the [IG Wealth Management Blog], “Financial mindfulness is the practice of being fully present and aware of your financial activities without judgment or emotional reactions. It involves being conscious of where your money is going, understanding your financial habits and making deliberate decisions instead of impulsive ones.”

Think of it as the pause between hearing a notification on your phone and picking it up. In that pause, you have a choice. With money, that choice sounds like: “Is this serving my future self, or just calming a temporary emotion?”

The Problem: Money on Autopilot

Many of us operate on financial autopilot. A bill arrives, we pay it. We feel stressed, we browse online. A sale appears, we click “buy.” These actions feel normal, but they are often driven by subconscious emotions rather than conscious goals.

Financial mindfulness is about turning off that autopilot. It is not about guilt, restriction, or rigid budgeting. It is about clarity. It shifts you from being managed by your money to managing your money with intention.

Mindless vs. Mindful Spending

Here is a simple comparison that highlights the difference:

| Feature | Mindless Spending | Mindful Spending |

| Primary Driver | Emotions (Stress, FOMO) | Core Values & Long-Term Goals |

| Decision Speed | Instant / Impulsive | Deliberate / Paused |

| Long-Term Result | Regret & Debt | Stability & Wealth Growth |

| Awareness Level | Autopilot | Fully Present |

The difference is not income level or financial knowledge. The difference is awareness.

Why This Approach Changes Everything

Credits: Raise the Bar

Financial mindfulness sits at the heart of our work because money is both practical and psychological. The numbers on your statement matter, but the story you tell yourself about those numbers matters even more.

When you build self-awareness and learn to regulate your nervous system, smart financial habits become sustainable. Instead of reacting from fear or anxiety, you begin acting from confidence and clarity. And that shift is where real financial transformation begins.

How Do Emotional Triggers Dictate Your Spending Habits?

Your brain often uses spending as a coping mechanism for stress, boredom, or social pressure. The urge to buy something can feel urgent and necessary, even when it is not. You may not consciously decide to spend, it simply happens.

Mindfulness helps you notice the feeling in your body before it reaches your wallet. Is there tightness in your chest? A sense of lack? Restlessness? That physical awareness is your first signal.

Emotions like anxiety, or what psychologists call the Ostrich Effect (avoiding financial reality) , can quietly drive impulsive behavior. The goal is not to eliminate emotions. That is impossible. The goal is to notice them without letting them take control. When you can name the feeling, you reduce its power.

Common Emotional Spending Patterns

Many spending habits follow predictable emotional loops. For example:

- The Stress Loop: Using shopping to soothe discomfort, only to feel more stress when the credit card bill arrives.

- Social Comparison (FOMO): Spending to keep up with a perceived lifestyle, creating a cycle that never truly satisfies.

- The Ostrich Effect: Avoiding bank statements or bills to escape short-term discomfort, which often leads to bigger long-term problems.

- Boredom or Restlessness: Chasing the temporary excitement of a new purchase to fill an emotional void.

These patterns are common, and deeply human.

Awareness Is the First Step, But Not the Only One

In many online discussions, people openly admit that “comfort spending” can feel automatic. Some try journaling. Others link purchases to meaningful goals, like saving for a home, to override impulse. These strategies can help, but awareness is always the starting point.

💬 What Our Partners Say

"Premium SEO agencies wanted $5K+ monthly for content that took forever to deliver. Cheap AI tools gave me content that didn't convert. JetDigitalPro hit that sweet spot - professional results…"

Peter BaranikFounder | Colorwee.com

"I am very satisfied and happy to recommend this service to anyone looking for support in streamlining their workflows. They are professional, cordial and respectful, in addition to the flexibility…"

AnnieLuFounder | BestFullyFundedScholarships.com

"Nell was accommodating, we used his VAs service for several months. Good work and great customer service. Recommend them for anyone who needs overseas VAs"

Jake LFounder | ScaleRankings.com

"I've finally found a content service that is truly hands-off. JetDigitalPro handles everything from keyword research to publishing directly on a WordPress site, and the topical authority strategy they use…"

Jose JimenezAgency Owner | JoliDigital.com

Ask yourself:

What happened right before I wanted to spend?

What was I feeling?

Over time, patterns begin to emerge. And when patterns become visible, change becomes possible.

What Are the Core Benefits of Practicing Money Mindfulness?

Money mindfulness does more than improve your bank balance. It reshapes your psychological relationship with money. When you reduce the constant worry, guilt, or avoidance around finances, you also reduce what many call the “mental tax” of financial stress.

The energy you once spent overthinking purchases or fearing your budget becomes available again, for clarity, creativity, and calm decision-making.

Reduced Financial Anxiety and Mental Clarity

Financial mindfulness lowers anxiety by helping you face your numbers with awareness instead of fear. When you stop avoiding your financial reality, the uncertainty begins to shrink.

As noted by the [Abacus Wealth Partners Blog], “If we could realize our money stress has more to do with our thoughts about our finances than the finances themselves, we could be happier, calmer, and wiser about money. It’s a decision to react the way we do to money events.”

Small, daily decisions become aligned with your larger goals. The result is not just financial progress, but emotional relief. You are no longer reacting, you are choosing.

Better Spending, Saving, and Debt Management

Practicing mindfulness naturally reduces impulsive purchases and improves debt management. A simple strategy, like implementing a 24-hour pause before non-essential purchases, often leads to greater satisfaction and less regret.

Awareness makes it easier to confront debt balances directly and move from panic or avoidance into planned, intentional action. Over time, savings rates improve because decisions are guided by long-term values rather than short-term emotions.

Nervous System Regulation and Smarter Decisions

High-stakes financial decisions can trigger stress responses that lead to rushed or fear-based choices. Mindfulness practices, such as focused breathing, help stabilize the nervous system. When your body is calm, your thinking becomes clearer.

This creates the foundation for earning an A in investing, where discipline and emotional steadiness matter more than reacting to market noise. This prevents panic-driven decisions and supports more rational, values-based action.

Long-Term Financial and Personal Well-Being

The benefits extend beyond money itself. Financial wellness is increasingly connected to overall mental health and even longevity. When you build awareness around your financial habits, you are not just building wealth, you are building peace. That sense of grounded control may be the most valuable asset of all.

Which Practical Techniques Improve Financial Decision-Making?

Integrating mindfulness into your financial life does not require hours of meditation. It requires small, consistent pauses during the moments that matter, especially before spending. Think of these practices as “speed bumps” on the road to impulse buying. They give your rational brain time to catch up with your emotional reaction. In that pause, better decisions become possible.

Build Small Pauses Into Everyday Spending

Effective techniques often focus on creating a cooling-off period. Daily financial check-ins and tracking expenses for one month can reveal patterns you may not have noticed before.

Another helpful strategy is the “Waiting List” approach: instead of buying immediately, write the item down and revisit it later. Many impulses fade when given time. These small interruptions insert intention into the automation of modern spending habits.

Use Simple Financial Frameworks

Structure supports awareness. A clear budgeting method, such as the 50/30/20 rule, can create conscious containers for your money, 50% for needs, 30% for wants, and 20% for savings or debt repayment. This shifts budgeting from restriction to alignment.

Another powerful tool is the “Hour Value” calculation. Before making a purchase, ask yourself how many hours of work it represents. This connects the price tag to your time and energy, making the decision more tangible and grounded.

Practical Mindfulness Techniques to Try This Week

Here are simple ways to strengthen mindful decision-making:

- The Body Scan Check: Pause for ten seconds before a purchase. Notice your body. Are you tense? Is your heart racing? Physical tension often signals emotional spending.

- The Digital Cleanse: Unsubscribe from promotional emails and texts. Remove unnecessary triggers that create artificial urgency.

- The Visualization Practice: Spend five minutes imagining your financial goal, being debt-free, building savings, creating freedom. Emotional clarity strengthens discipline.

- The Values Filter: Write down your top three financial values (such as security, freedom, or family). Before spending, ask whether the purchase supports one of them.

- The Weekly Money Date: Set aside 20 minutes each week to review your accounts and adjust your plan. Approach it with curiosity, not criticism.

These techniques are simple, but their impact compounds. When mindful choices become routine, financial confidence grows naturally.

How Can You Navigate the “Real World” Challenges of Mindful Finance?

In theory, mindful finance sounds simple. In reality, it can feel much harder. Online communities like Reddit and X show just how deeply ingrained money habits can be. People openly share their struggles, failed attempts, and small victories.

These conversations reveal something important: perfection is not the goal, consistency is. Sometimes journaling helps. Other times, you need a physical barrier, like freezing a credit card in a block of ice, just to create a pause long enough to think.

From Ideal Plans to Workable Systems

Real-world success comes from building systems that work in messy, everyday life. You will still feel the urge to spend. You will still have emotional reactions. Mindfulness is not about eliminating those feelings.

It is about noticing them and, when possible, choosing differently. It also means recognizing the high cost of being flawless and releasing perfectionism in your financial life.

Setbacks are part of the process. What matters is returning to awareness. When people share their struggles publicly, it normalizes the experience. Financial stress shifts from private shame to shared humanity. That perspective alone can reduce pressure and increase resilience.

What Different Platforms Reveal About Money Struggles

Each platform highlights a different dimension of mindful finance. Here is a summary of real-world insights:

| Platform | Key Insight | Common Pain Point |

| Tie spending to a specific, visual goal (like a photo of your future home). | “Comfort spending” feels like a survival reflex, not just a bad habit. | |

| X (Twitter) | Use short meditation practices to stay calm during market swings. | News cycles and social media create artificial financial urgency. |

| YouTube | Practice body awareness to shift from reactivity to responsiveness. | There is often a gap between knowing what to do and actually doing it. |

| Trading Forums | Emotional discipline is the true professional advantage. | Beginners overvalue technical tools and undervalue psychology. |

These insights reinforce a core truth: financial knowledge alone is not enough. Emotional awareness and nervous system regulation are what allow knowledge to translate into action. When you combine practical tools with mindful awareness, you create a strategy that works not just in theory, but in real life.

FAQ

What is financial mindfulness and how does it help daily decisions?

Financial mindfulness means paying attention to your thoughts and emotions before making money choices. It builds financial self-awareness and improves financial decision awareness in everyday life.

Instead of reacting automatically, you practice conscious spending and develop mindful money habits. Over time, this strengthens emotional financial control, reduces stress, and helps you make aware financial choices aligned with your real priorities.

How can I recognize emotional spending triggers?

Emotional spending triggers often show up as stress, boredom, or anxiety right before a purchase. Building impulse buying awareness starts with noticing emotional spending patterns in your body and thoughts.

Practice money trigger identification by pausing and asking what you are feeling. This improves money anxiety awareness and supports emotional impulse management before you act.

What are simple money mindfulness techniques I can start today?

You can begin with a spending pause practice before non-essential purchases. Try a quick money emotion check-in or short money mindfulness meditation. Keep a conscious spending log or emotional spending journal to track patterns.

These financial mindfulness exercises increase financial presence practice and help you build intentional money choices with clarity and calm.

How does mindful budgeting reduce financial stress?

Mindful budgeting focuses on conscious budget alignment rather than restriction. It encourages mindful expenditure tracking and aware money allocation based on your values. This strengthens financial emotion balance and supports a mindful savings strategy.

With consistent financial stress mindfulness, you reduce financial regret minimization and build long-term financial choice clarity.

Can mindfulness improve investing and long-term wealth?

Yes, mindfulness supports mindful investing and aware investment decisions by improving financial impulse control. It encourages mindful risk assessment and a conscious investment strategy instead of reactive behavior.

With emotional wealth consciousness and mindful wealth management, you build aware wealth building habits while practicing money emotion regulation for steadier long-term growth.

Your Path to Mindful Money Management

Your journey begins with one simple pause. The next time you feel the urge to spend, or avoid your banking app, take a breath and ask, “What’s really happening?” That moment of awareness shifts money from stress to agency.

Practice small daily check-ins, pause before purchases, and reflect without judgment. Over time, these moments build lasting confidence. Ready to begin? Explore your next step at spencer-sherman.com.

References

- https://www.ig.ca/en/insights/financial-mindfulness–the-key-to-enhancing-your-financial-life

- https://abacuswealth.com/5-mindfulness-practices-that-change-how-we-relate-to-money/

Related Articles

- https://www.spencer-sherman.com/five-money-meditations-based-on-thich-nhat-hanhs-wisdom

- https://www.spencer-sherman.com/how-to-get-an-a-in-investing

- https://www.spencer-sherman.com/the-high-cost-of-being-flawless

Ready to Get Content That Actually Ranks?

Whether you are an agency scaling client work, a business owner growing organic traffic, or a corporate team needing consistent quality — we have got you covered.

🔒 NDA included. White-label ready. Cancel anytime.

📖 More Content Examples Worth Exploring

The Psychology of Your Financial Numbers Made Simple

The Psychology of Your Financial Numbers Made SimpleAI Detection Score Topical Score Readability Fact Checking SectionScore (/10)ReasoningKey Takeaways9Aligns with financial psychology principles; income/expenses reflect coping/values, assets/liabilities show…

How to Get a Phentermine Prescription Online: A Step-by-Step Guide to Same-Day Approval

How to Get a Phentermine Prescription Online: A Step-by-Step Guide to Same-Day ApprovalAI Originality Score Topical Score Readability Score EAV Analysis EntityAttributeValueScore (1–10)ReasoningPhentermineMedication TypePrescription appetite suppressant10Defines the entity; core to user intent.Prescription…